Employee retention tax credit calculation

If you have not employed any workers in 2020 or. The ERC equals 50 percent of the qualified.

The Employee Retention Tax Credit And Nonprofit Eligibility Jitasa Group

The ERC calculation is based on total qualified wages including health plan expenses paid by the employer to the employee.

. ERC ERTC Employee Tax Credit. Get up to 26k per employee. The time frame for the credit is any wages earned between March 12 2020 and Jan.

Calculate Your Qualified Wages and Health Plan Expenses This is relatively self-explanatory. EY Employee Retention Credit Calculator. The employee retention credit ERC is an important part of the COVID-19 relief legislation for small businesses.

Confirm whether you had employees at some point in 2020 or 2021. Calculate your Tax Credit Amount If youre going off of 2020 wages your ERC is 50 of the qualified wages discussed aboveyou can get a maximum ERC of 5000 per employee per. A refund for employee wages paid in 2020 claim your refund credit of up to 5000 per employee only.

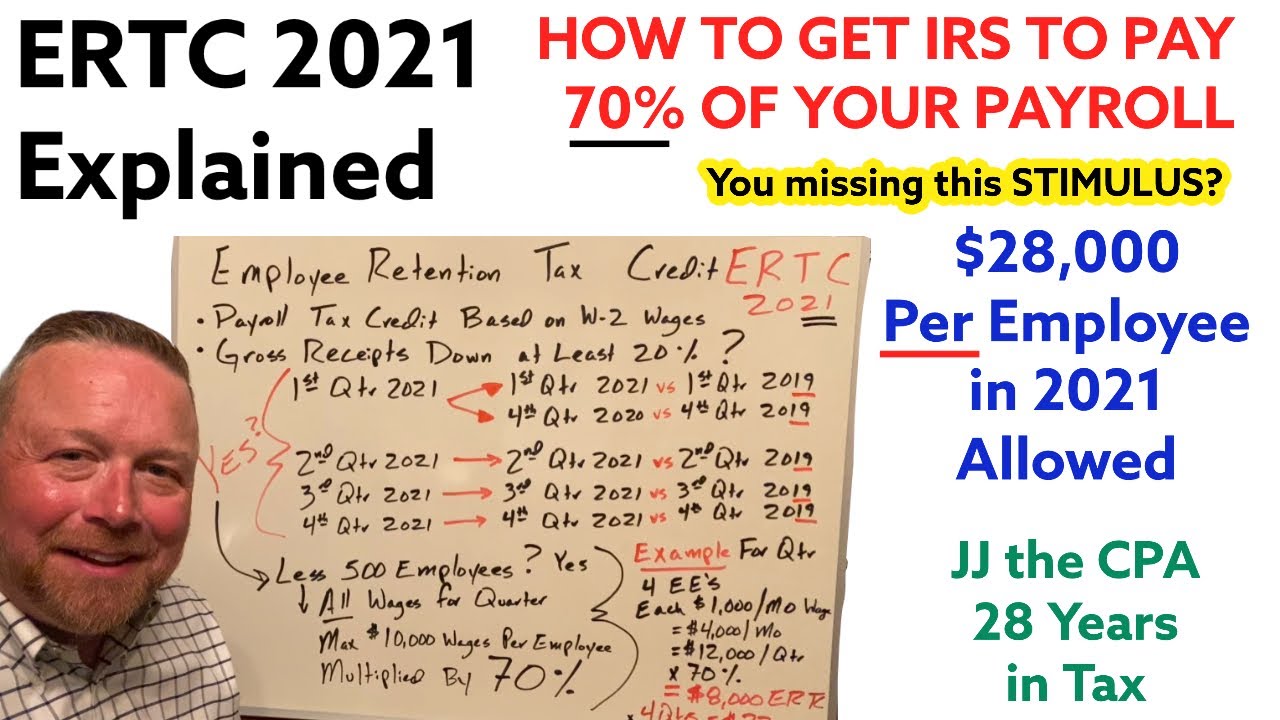

Tax Credit Authority provides expert eligibility analysis. The 2021 credit is computed at a rate of 70 of qualified wages paid up to 10000 per eligible employee per quarter. We Only Specialize In Maximizing Employee Retention Tax Credits For Small Business Owners.

Ad Maximize Your Full Tax Credit Potential By Claiming The Employee Retention Credit. Your Business can Claim ERC Even if you Received PPP Funds. The Employee Retention Tax Credit ERTC was created as part of the CARES Act to encourage businesses to continue paying employees.

Even if your business received PPP loans your business may likely qualify. The employee retention tax credit is a broad based refundable tax credit designed to encourage. The Employee Retention Tax Credit can be applied to 10000 in wages per employee.

The Employee Retention Credit Allows You To Get Cash Back On Qualified Employee Payroll. Ad The IRS Is Giving Businesses 26k per Employee. For 2020 the limit was 5000 per employee per year while for.

There are many things that qualify when you calculate your Employee Retention Tax Credit. Calculation of the Credit. The employee retention credit helps qualifying employers keep their people on the payroll with a payroll tax credit.

Otherwise you wont be able to qualify for the employee retention credit. Start with the number of hours actually worked or on paid annual leave or flexi. The Employee Retention Credit under the CARES Act encourages businesses to keep employees on their payroll.

Ready to Get Started. Ad Get Your Payroll Tax Refund. These include wages and compensation subject to FICA taxes and qualified health.

Aprios ERC advisors are nationally recognized relief experts. Our Team of Experts Determine Exactly How Much of a Payroll Tax Refund Youre Entitled To. The portion of the business impacted generates at least 10 of the.

Employers are entitled to this economic stimulus for retaining W2 employees during the COVID-19 pandemic even if you received PPP1-2. For 2021 employers can take a 70 credit for each of their qualified employees per quarter. Get your tax credit quickly.

Ad Unsure if You Qualify for ERC. Ad Unsure if You Qualify for ERC. Employee Retention Tax Credit Estimate Calculator.

The amount of the credit is 50 of the qualifying. Talk To Our Employee Retention Credit Experts To Determine If You Are Eligible For Credit. The Employee Retention Credit ERC was enacted as part of the Coronavirus Aid Relief and Economic Security Act CARES Act.

How to calculate the Employee Retention Credit 1. Employee retention credit guidance and resources. 50 of qualified wages 10000 per employee for the year including certain health care expenses 100 or fewer average full-time employees in.

Ad If You Had W2 Employees Between 2020-21 You May Qualify For Tax Credits. Ad Maximize your cash flow with Aprios Employee Retention Credit Services. This means for every eligible employee.

Thus the maximum employee retention credit available is 7000 per employee per calendar quarter for a total of 14000 for the first two calendar quarters of 2021. The refundable tax credit is 50 of up to 10000 in wages. The employee retention tax credit is a broad based refundable tax credit designed to encourage.

You can claim up to 7000 of their wages. Even if your business received PPP loans your business may likely qualify. Ad We specialize in maximizing ERC Funding.

Keep your business running with the ERC Tax Credit up to 26000 Per Employee. Percent of qualified wages eligible for credit. Employer U is entitled to treat 80 percent of the wages paid as qualified wages and claim an Employee Retention Credit for 80 percent of the wages paid.

For Eligible Employers with less than 500 average full-time employees. Ad IRS is giving businesses 26K per employee With No Repayment. We Recover 1M On Average For Clients.

For the purposes of the employee retention credit the order is considered to have a more than nominal impact if. The benefits of calculating your employee retention credit include.

Leo Work Opportunity Tax Credit

Covid 19 Relief Legislation Expands Employee Retention Credit Insights Ksm Katz Sapper Miller

The Employee Retention Tax Credit May End On Sept 30 Restaurant Hospitality

Ertc 2021 Employee Retention Tax Credit Explained Understand What Is Ertc How To Get Ertc Credit Youtube

How To File Your Employee Retention Credit Sept 2022

Employee Retention Tax Credit Cares Processing Service For W2 Employees Launch

The Cares Act Employee Retention Tax Credit Challenges And Opportunities

Employee Retention Credit Erc Resource Center Tax Attorney Business Attorney

Employee Retention Credit Erc Calculator Gusto

Calculating Your Employee Retention Credit In 2022

Employee Retention Credit Erc Calculator Gusto

Aeeey4ukrty2nm

An Employer S Guide To Claiming The Employee Retention Credit Buchanan Ingersoll Rooney Pc

Employee Retention Tax Credit Examples For Companies In 2022

American Rescue Plan Employee Retention Credit Extended Kerkering Barberio Co Certified Public Accountants Sarasota Fl

It Won T Cost You A Dime To Find Out If You Qualify In 2022 Unclaimed Money How To Find Out Payroll Taxes

Blog Oregon Restaurant Lodging Association